Heloc amortization calculator with extra payments

Once you have filled out all your information click on the calculate button to see the side-by-side results for your old loan and the loan with extra payments made. The HELOC payment calculator generates a HELOC amortization schedule that breaks down each monthly payment with interest and the principal amount that a borrower will be paying.

Heloc Calculator

Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise.

. The auto loan calculator is able to calculate any type of auto loans and generate a car loan amortization schedule with principal interest and balance for each payment. Extra payments allow borrowers to pay off their home mortgages or personal loans faster. This ultimately reduces the amount of interest you pay.

Click Show amortization schedule to reveal the section that. 30 year Interest RatePayoff. You could add 360 extra one-type payments or you could do an extra monthly payment of 50 for 25 years and then an extra monthly payment of 100 for 3 years etc.

Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance. Any additional extra payments throughout the loan term should be applied. Our calculator can help you crunch the numbers to determine the right choice for you.

Annuitization amortization and required minimum distribution. Auto Loan Amortization Calculator. 30 Years Interest PaymentTotal PaymentExtra.

Rates can be fixed or adjustable. See how those payments break down over your loan term with our amortization calculator. Car Loan Amortization Schedule With Extra Payments.

Download a free ARM calculator for Excel that estimates the monthly payments and amortization schedule for an adjustable rate mortgageThis spreadsheet is one of the only ARM calculators that allows you to also include additional payments. The monthly interest rate is calculated via a formula but the rate can also be input manually if needed ie. Seller Closing Cost Calculator.

To calculate amortization with an extra payment simply add the extra payment to the principal payment for the month that the extra payment was made. Learn more about specific loan type rates. Click the View Report button to see a complete amortization payment schedule.

Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance. To get a home loan amortization schedule with taxes and insurance please use the amortization schedule with extra payments. Allows extra payments to be added monthly.

A HELOC can help you to lower your debt payments by lowering your interest rate. We compare your annual PMI costs to the costs you would pay for an 80 percent loan and a second loan based on how much you make for a down payment the interest rates for each loan the length of each loan the loan points and the closing costs. The seller closing cost calculator is able to calculate the real estate commission title escrow transfer tax and closing costs as a percentage of your home sale price or as a dollar amount.

If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. If you want to see the effect of making extra payments over the entire length of the loan just enter the full length of the loan in both places. Since borrowers only pay interest in the interest-only period the HELOC amortization schedule for that period will be just for interest payments and 0 for the principal.

Extra Payments In The Middle of The Loan Term. Qualifying typically requires a significant down payments and good credit scores. The mortgage amortization schedule shows how much in principal and interest is paid over time.

The calculator will immediately display your regular monthly payment for the loan in the place indicated. Lets take a look at the following example. For example on October 8 2020 the national average interest rate for a 30-year fixed rate mortgages was 287 percent while the average credit card interest rate on cards assessed interest stood at 1643 percent in August 2020.

By making extra payments on a regular basis or a large one-time lump sum payment toward principal may save a borrower thousands of dollars in interest payments and may even cut a few years of the loan terms depending on the size of. How we make money. This tool figures a loans monthly and balloon payments based on the amount borrowed the loan term and the annual interest rate.

Bankrate is compensated in exchange for featured placement of sponsored products and. The IRS has approved three ways to calculate your distribution amount. You may choose any of the three methods on which to base your distribution amount.

If you are planning to sell your house use this home sale calculator to estimate the total costs and proceeds that you will receive for selling your house. The amount of money that you can save with extra payments depends on a few variables the interest rate term loan balance number of extra payments and the size of the extra payments. Internal Revenue Code IRC Section 72t2Aiv defines these distributions as Substantially Equal Periodic Payments.

Extra payments on a mortgage can be applied to the principal to reduce the amount of interest and shorten the amortization. For example if you are 35 years into a 30-year home loan you would set the loan term to 265. Most homebuyers choose the 30-year fixed loan structure.

Use our amortization calculator to estimate your monthly principal and interest payments made over the life of a loan. This mortgage payoff calculator helps you find out. Bi-weekly payments equate to one extra payment each year and 51 fewer months on a 30-year loan.

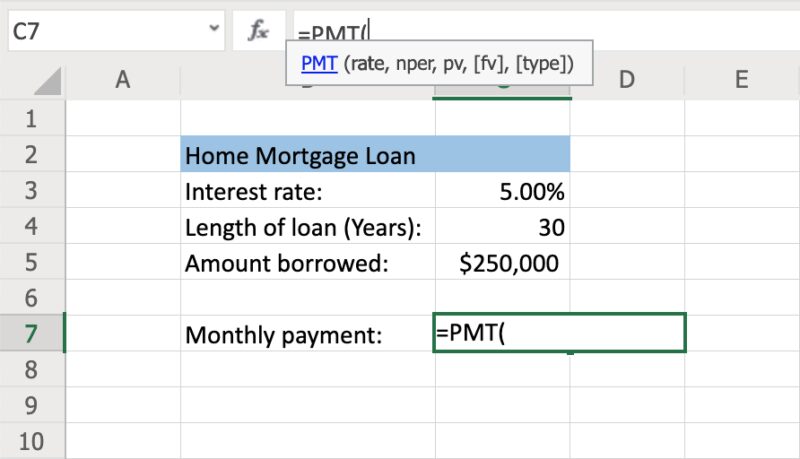

The car loan amortization schedule with extra payments give borrowers the options to see how much. The calculator updates results automatically when you change. Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions.

Shows total interest paid. Conforming loans have a price limit set annually with high-cost areas capped at 150 of. We offer a calculator which makes it easy to compare fixed vs ARM loans side-by-side.

Our Excel mortgage calculator spreadsheet offers the following features. The simple amortization calculator excel requires only 3 fields loan amount terms and interest rate. Amortization Schedule with Extra Payments.

Building a Safety Buffer by Making Extra Payments. Next enter the amount of the loan and the interest rate. Find out if a HELOC home equity loan or cash-out refinance is best.

Bankrates mortgage amortization schedule calculator can help you determine the impact of extra payments on your mortgage. Calculator Rates Balloon Loan Calculator. Loan Amortization Schedule Excel.

Then once you have calculated the monthly payment click on the Create Amortization Schedule button to create a report you can print out.

Heloc Payment Calculator With Interest Only And Pi Calculations

How To Calculate Equity In Your Home Nextadvisor With Time

Looking For A Heloc Calculator

Mortgage Calculator With Extra Payments Top Sellers 50 Off Www Wtashows Com

Home Equity Loan Surge Offers Opportunities For Signing Agents Best Money Saving Tips Home Equity Loan Saving Money

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Payment Calculator Store 59 Off Www Wtashows Com

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Mortgage Payoff Calculator With Line Of Credit

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Mortgage Accelerator Spreadsheet Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Loans

Heloc Payment Calculator Store 59 Off Www Wtashows Com

How To Calculate Monthly Loan Payments In Excel Investinganswers

Loan Payoff Calculator Paying Off Debt Mls Mortgage Loan Payoff Credit Card Consolidation Credit Card Payoff Plan

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Heloc Payment Calculator Store 59 Off Www Wtashows Com